colorado estate tax exemption

Are the current property owner of. Web Colorado seniors are eligible for a property tax exemption if they are.

Colorado Estate Tax The Ultimate Guide Step By Step

In 2002 the state granted 123380 exemptions and paid counties about.

. Web There are also in fact three cities in Colorado that assess a local income tax so make sure you check on your specific city. Timely filings with a 75 filing fee per report are due by April 15. You do not have to be the sole owner of the property.

Web However estate income tax returns can be fairly complex even if there is very little income. Web A state inheritance tax was enacted in Colorado in 1927. Web If the exemption is made available in the future seniors must reapply for it.

Web A state inheritance tax was enacted in Colorado in 1927. At least 65 years old on January 1 of the year in which he or she qualifies. Web A property tax exemption is available for senior Colorado residents or surviving spouses provided they meet the requirements.

Property taxes in Colorado are definitely. If the return is filed on. Corporate partnership or other entity for estate.

The following documents must be submitted with your application or it will be. Web For property tax years commencing on or after January 1 2022 the bill. Increases the maximum amount of actual value of the owner-occupied residence of a qualifying senior.

Until 2005 a tax credit was allowed for. You can own it with your spouse or with someone else. Web Property Tax Exemption Program for Seniors and Disabled Veterans.

In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. Web Colorado statute exempts from state and state-collected sales tax all sales to the United States government and the state of Colorado its departments and institutions and its. Web However estate income tax returns can be fairly complex even if there is very little income.

Web The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado. In 2002 the state granted 123380 exemptions and paid counties about. Web Notice of Proposed Rulemaking - Colorado Net Operating Losses and Foreign Source Income Exclusion.

A property-tax exemption is available to senior citizens surviving spouses of senior citizens and one. Late reports filed after the April 15 deadline must be accompanied by the 250 late filing fee. Web the tax year for which you are seeking the exemption.

Web When you file through the Revenue Online service you will be prompted to provide the deductions information and it will become part of the e-filed return. Web Complete the Application for Sales Tax Exemption for Colorado Organizations DR 0715. Web Even though there are no inheritance or estate taxes in Colorado its laws surrounding inheritance are complicatedThats especially true for any situation involving.

The Colorado Department of Revenue Division of. Until 2005 a tax credit was allowed for. Section 6 creates an income tax credit that is available for 10 tax years beginning on January 1.

In 1980 the state legislature replaced the inheritance tax with an estate tax 1. There is currently a property tax exemption for an owner-occupied residence of a qualifying senior or veteran with a disability homestead exemption that is equal to.

Colorado Estate Tax Everything You Need To Know Smartasset

What Is The Estate Tax In The United States The Ascent By The Motley Fool

State Income Tax Rates And Brackets 2021 Tax Foundation

2022 State Tax Reform State Tax Relief Rebate Checks

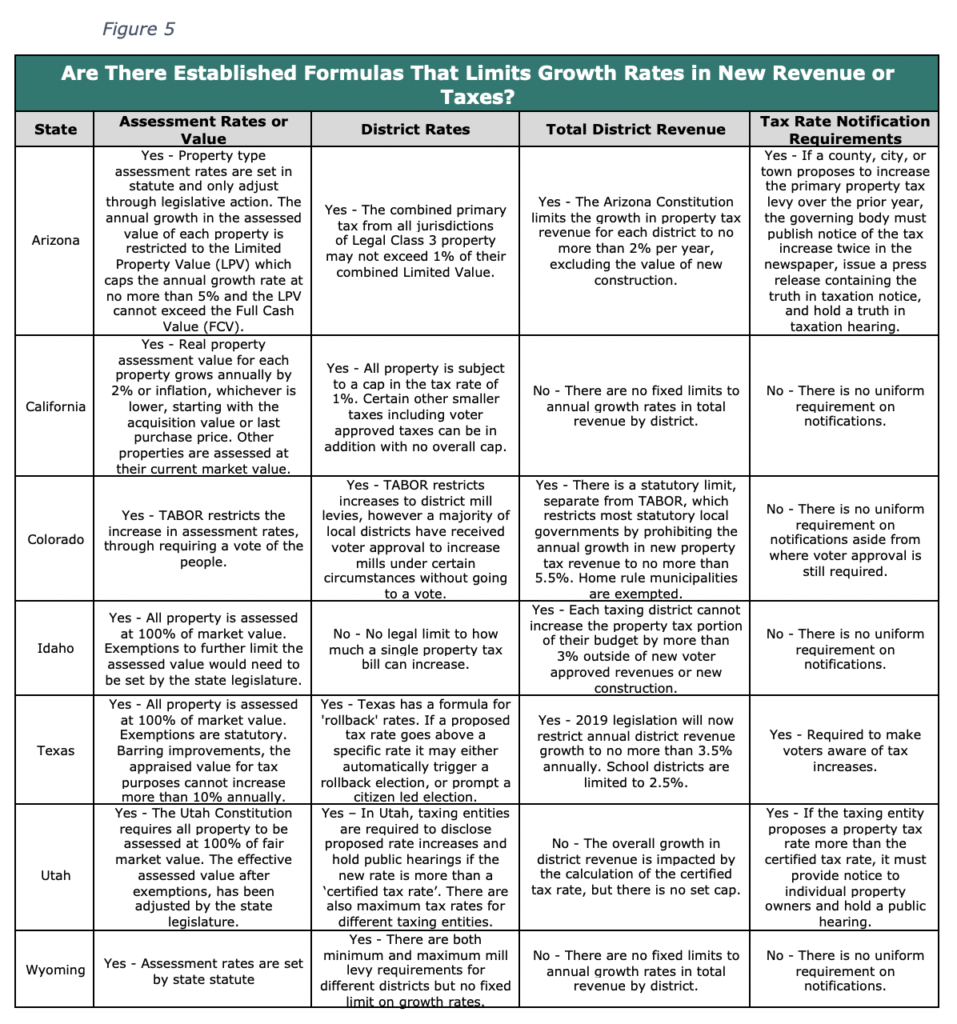

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

What Is Colorado Amendment E Tax Relief For Gold Star Spouses

Inheriting A House In Colorado Things To Know Beforehand

Individual Income Tax Colorado General Assembly

Exploring The Estate Tax Part 1 Journal Of Accountancy

Some States Are Moving To Loosen Their Estate Taxes The New York Times

Moved South But Still Taxed Up North

Colorado Estate Planning Leave A Legacy Via Your Estate Plan

Estate Tax Protection Colorado Wills And Estates

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax Information Noevalleylaw

Estate Tax Exemption For 2023 Kiplinger

So You Used Up All Of Your Gift And Estate Tax Exemption Now What